Tally VAT Ready

Tally is a powerful accounting software that has been designed to help businesses of all sizes manage their finances and comply with VAT regulations. With Tally VAT enabled, businesses in UAE can easily calculate and file their VAT returns, ensuring compliance with the VAT regulations set by the Federal Tax Authority (FTA).

Tally Prime VAT Key Modules

VAT Compliance

Tally VAT enabled helps businesses comply with VAT regulations by providing tools to calculate VAT accurately, generate VAT returns, and track VAT payments.

Multi-Currency Support

ally VAT enabled offers support for multiple currencies, making it easy for businesses to manage their finances across different countries.

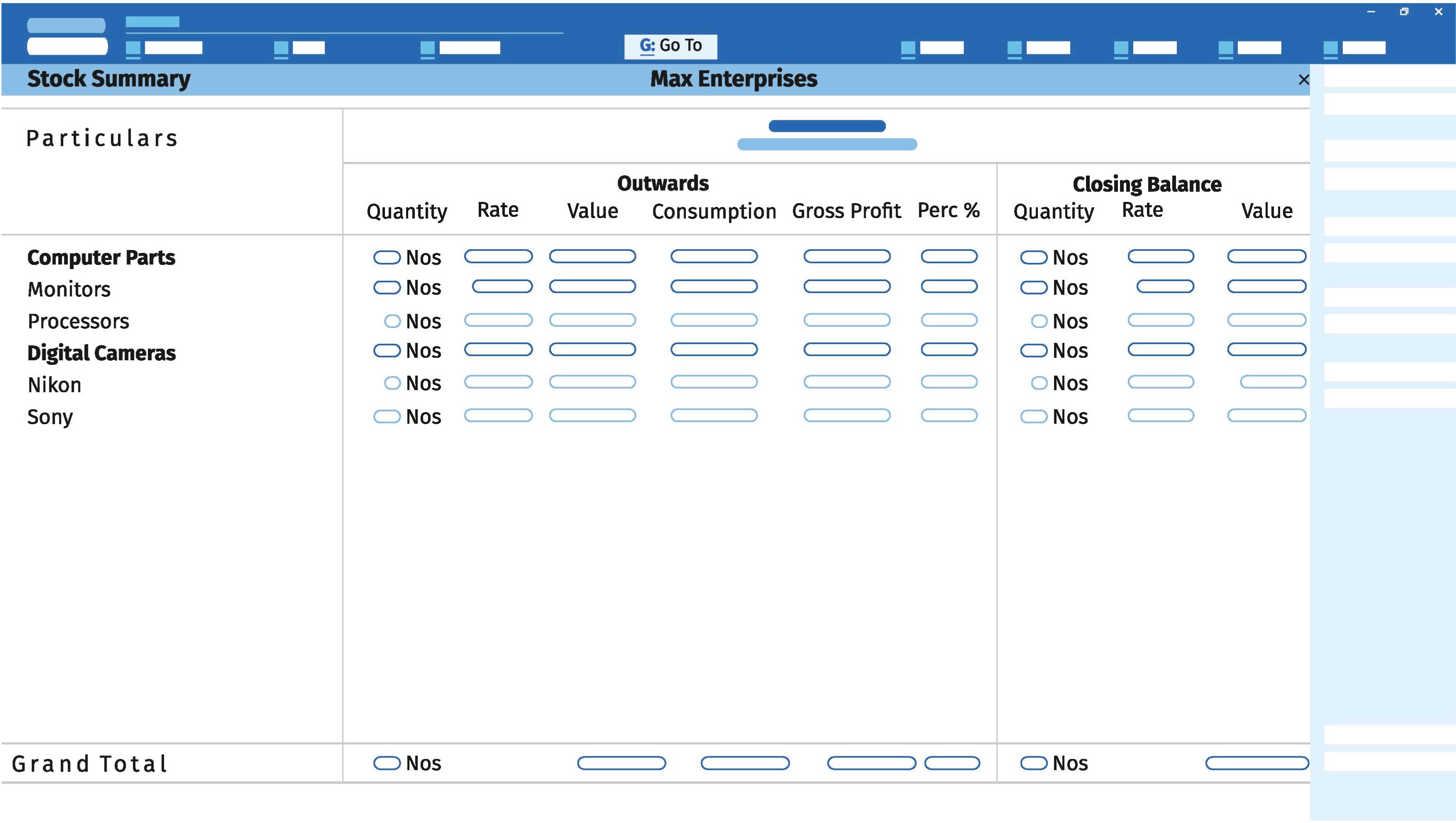

Inventory Management

Tally VAT enabled includes powerful inventory management features that allow businesses to manage their stock levels, track inventory movements, and generate reports.

Financial Accounting

Tally VAT enabled provides robust financial accounting tools, including ledgers, vouchers, and financial statements, allowing businesses to manage their finances effectively.

Customizable Invoicing

Tally VAT enabled allows businesses to customize their invoices to include their company logo, address, and other details.

Data Security

Tally VAT enabled includes advanced security features that ensure the confidentiality, integrity, and availability of data.

VAT Ready Tally Prime

In addition to these features, Tally VAT enabled also offers comprehensive support and training services to help businesses optimize their use of the software. Tally's support team is available to provide assistance with installation, training, and troubleshooting, ensuring that businesses can focus on running their operations without worrying about the technical aspects of their accounting software .

VAT Ready Tally Accounting Software

Tally VAT enabled is an essential tool for businesses in UAE that want to comply with VAT regulations while managing their finances effectively. With its powerful features, user-friendly interface, and comprehensive support services, Tally VAT enabled is the ideal solution for businesses looking to streamline their accounting processes and improve their financial management.